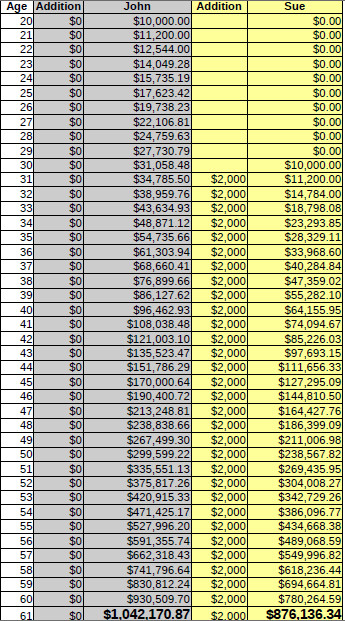

Once Warren Buffett said, that the best time to start investing is 20 years ago, and the second best time is ... now. The earlier you start doing it, the most advantage you take of the power of compounding. To give you a proof, lets examine the following example in the table below.

John started investing when he was 20 years old. The only thing he did is to put $10 000 into a mutual fund. Then he just forgot about his investment for the next 41 years.

Sue decided to start investing like John, but this happened when she was 30. In order to catch him, she decided to put $10 000 dollars in the same mutual fund and also to add $2 000 every year from then on.

The mutual fund yielded 12% on average, this is the average return of the US stock market.

Years passed and John and Sue got 61 . The $10 000 investment of John has compounded to more than a million dollars and he became a millionaire. Sue started later, but she did her best to catch up with John, adding $2 000 every year to her same investment of $10 000. But she never reached John. He had only $876 000 .

This is why it's totally important to start as early as possible.

If you like this post, please, share it with friends.

This comment has been removed by a blog administrator.

ReplyDelete